He Cares

![]()

![]()

Secure Peace of Mind for Your Loved Ones: Final Expense Insurance with The Final Expense Guy

Worried about leaving your loved ones with unexpected funeral expenses? The Final Expense Guy can help! We specialize in providing personalized attention and expert guidance to navigate the world of final expense insurance.

Why Choose The Final Expense Guy?

- Your Advocate: We go beyond just selling insurance. The Final Expense Guy acts as your trusted advisor, understanding your unique needs and goals.

- Unmatched Expertise: Benefit from our in-depth knowledge of the final expense insurance industry. We’ll help you find the right coverage at the right price.

- Compassionate Care: We understand the sensitive nature of end-of-life planning. The Final Expense Guy offers personalized attention with patience and empathy.

- Crystal-Clear Communication: No confusing jargon! We’ll thoroughly explain your options and ensure you understand every aspect of final expense insurance.

- Integrity Matters: Our commitment to honesty and transparency is paramount. You can trust The Final Expense Guy to always put your needs first.

Peace of Mind for You and Your Family:

- Alleviate Financial Burdens: Final expense insurance ensures your loved ones aren’t left with the cost of your funeral and related expenses.

- Plan for the Future: The Final Expense Guy will guide you through every step of securing your legacy and achieving financial security for your family.

- Free Quotes & Personalized Guidance: Contact The Final Expense Guy today! We offer complimentary quotes and a no-obligation consultation to answer your questions and develop a personalized plan.

Don’t wait until it’s too late. Take control of your future and ensure peace of mind for your loved ones. Contact The Final Expense Guy today!

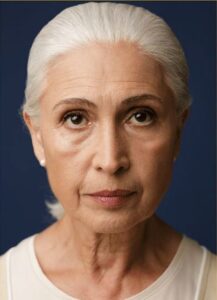

You Will Go From This

To This

JUST SOME OF THE KIND TESTIMONIALS

Thanks for helping me with the insurance. You are the only person who made things simple and met my needs.

Thanks again. Nancy

##

“, your energy in assisting me; your concern for my well-being & that of the people important to me!!! Your efforts to find me the best and most affordable policies available to me have not gone unnoticed; unrecognized or unappreciated by me!!! “meant a great deal to me; more than you’ll ever know or I’m able to put into words!!! “

Elise

##

Whether his clients are looking to purchase a final expense insurance policy, plan their funeral arrangements, or simply gain a better understanding of their options, the final expense guy is always there to lend a helping hand. He is patient, empathetic, and compassionate, and he always puts his clients’ needs first.

Overall, the final expense guy is someone who is truly dedicated to helping his clients achieve peace of mind and financial security as they plan for the future. He is a true professional in every sense of the word, and his commitment to integrity, honesty, and respect is something that his clients truly appreciate and value.

Don’t leave your loved ones with a financial burden when you’re gone. Protect them with final expense insurance today. To get a free quote and learn more about this valuable coverage, FILL IN BELOW

CONTACT TO GET YOUR QUOTE AND PERSONALIZED ATTENTION THAT LOOKS OUT FOR YOU, YOUR ADVOCATE!

Why YOU should consider Burial Insurance

Final Expense Insurance for Seniors: A Simple Guide to Peace of Mind

Planning for the future is an important part of aging. Final expense insurance can help ease the burden on your loved ones by covering funeral and burial costs.

What is Final Expense Insurance?

- Also known as burial insurance or funeral insurance.

- Designed to cover funeral and related expenses.

- Provides peace of mind for you and your family.

Senior-Friendly Options:

- Guaranteed issue life insurance: No medical exam or health questions required.

- No medical exam life insurance: Simplified application process, may ask health questions but no physical exam needed.

Popular Choice: Whole Life Insurance for Seniors

- Lifetime coverage: Protects your loved ones throughout your life.

- Builds cash value: Accumulate savings over time, accessible for various needs.

- Legacy potential: Leave a financial gift for your loved ones.

A Simple Approach to Life Protection

Final expense insurance is about love – for your spouse, children, grandchildren, or other loved ones. It ensures they aren’t burdened with unexpected costs (average funeral: $10,000).

Get a Quote Today!

We understand the importance of simplicity. Contact us for a free, no-obligation quote on final expense insurance tailored to your needs. Let’s discuss how to achieve peace of mind for you and your family.

Final Expense vs. Term Life: Choosing the Right Coverage for You (Free Quote!)

Confused by Final Expense vs. Term Life Insurance? We can help!

Final Expense Insurance: Ideal for seniors who want guaranteed coverage for end-of-life expenses:

- Guaranteed Lifetime Coverage: Protects your loved ones from funeral costs (typically $5,000 – $25,000).

- Affordable Premiums: Simple and budget-friendly monthly payments.

- No Medical Exam Required: Easy to qualify, even with health concerns. Choose between:

- Guaranteed Issue Life: Guaranteed acceptance, lower death benefits.

- Simplified Issue Life: Up to $50,000 coverage, answer health questions (no exam).

Term Life Insurance: Provides temporary coverage at a lower cost:

- Choose Your Term: Get coverage for a specific period (10-30 years).

- Lower Premiums (Initially): Great for younger budgets or temporary needs.

- Coverage May Lapse: Policy ends after the term, potentially leaving loved ones with no benefit.

- May Require Medical Exam: Qualification depends on health history.

Which is Right for You?

- Final Expense: Ideal for guaranteed coverage of final expenses, regardless of health.

- Term Life: Great for temporary needs or younger individuals seeking lower initial costs.

Get a Free Quote Today!

Our experts can help you compare plans and choose the best option for your needs.

- Secure Your Loved Ones’ Future: Give them peace of mind with financial protection.

- No Obligation, Find the Perfect Fit! We work for you, not any one company.

Call now! Protect your family and achieve peace of mind.

Searching for reliable burial insurance options or final expense insurance plans?

Look no further! Our comprehensive selection includes whole life insurance tailored to seniors, ensuring their final expenses are covered without hassle. With our senior life insurance policies, you can rest assured knowing that your loved ones won’t be burdened with funeral costs. Our burial insurance plans provide affordable options for senior care, offering peace of mind during difficult times. Plus, our no medical exam life insurance makes the process even easier. Explore our range of final expense insurance and senior life care plans today to secure your future and protect your loved ones from the financial strain of elder care coverage. With affordable burial options for seniors and pre-planning options available, we’ve got you covered every step of the way.